Financial Abuse (including SCAMS and Frauds)

What is Financial abuse?

Financial abuse is:

“The unauthorised and improper use of funds, property or any resources belonging to another individual.”

It includes:

It includes:

- theft, fraud and exploitation,

- pressure in connection with wills, property, inheritance or financial transactions, misuse or misappropriation of property, assets, possessions, savings, capital or benefits.

- SCAMS and other forms of fraud, both on line, postal and door stop crimes

Types of financial abuse may include

- Theft i.e. money or possessions stolen, borrowed or withheld without permission. · Wrongfully controlling access to money or benefits.

- Preventing someone buying goods, services or leisure activities.

- Money being absorbed into a care home or household budget without the person’s consent.

- Being deliberately overcharged for goods or services, or being asked to part with money under false pretences.

- Not providing the care (1 to 1 and shared hours) but charging the client.

- Carrying out unnecessary work and / or overcharging.

- Postal, telephone and internet scams where the person has interacted with someone and has lost money.

- Unlicensed money lending (loan sharks) i.e. being offered a loan on very bad terms.

- Staff or volunteers borrowing money, or accepting gifts or money from clients.

- Misuse of a person’s assets by professionals

- Altering ownership of property without consent.

- Exerting undue influence to give away assets.

- Pressure in connection with wills, property, inheritance, possessions or benefits.

- Putting undue pressure on the person to accept lower-cost / lower quality services in order to preserve more financial resources to be passed to beneficiaries on death.

- Misuse of powers of attorney.

The impact of financial abuse should not be underestimated and can be every bit as significant as physical abuse. Even small losses have the potential for significant impact when considered in context with a person’s overall wealth / income and whether or not they have access to the right support.

The negative impact of financial abuse, regardless of the source, can leave people unsettled and without the confidence to live independently. It can cause the person who previously did not have a need for social care services to deteriorate to the level at which they require services. How does financial abuse affect someone?

A person may experience any of the following:

- Depression / anxiety

- Distress

- Anger

- Embarrassment / loss of self-esteem

- Self-blame – decline in mental health

- Denial / fear

- Betrayal

- Stress and Loss of confidence to live independently

- Deterioration in physical health (leading to premature death)

- Social isolation

- More vulnerable to further exploitation

- Inability to replace lost savings due to lack of earning potential

When financial abuse is reported all agencies must respond quickly to minimise the harm and abuse as follows:

- All suspicions or incidents of financial abuse of a vulnerable adult MUST be reported to Buckinghamshire Safeguarding Adults Team (MASH) as the lead agency for Safeguarding adults.

- Suspicions or incidents of financial abuse of a vulnerable adult MUST be reported to the police if this is the wish of the individual.

- Priority MUST be given by all agencies to participate in safeguarding adults multi agency planning meeting so a multi-agency plan to protect and investigate the concerns can take place.

- The individual’s views and wishes must be ascertained as quickly as possible.

- Individuals must be made aware of the concerns and the possible consequences. They must be supported to make informed decisions – this may be by the provision of information and/or the support of an advocate.

- Individual capacity, if in question, must be assessed.

- Take immediate action to protect the individual from further harm and abuse..

- Work closely with the police to ensure vulnerable adults can make a complaint and give a statement – this may include accessing advocates, interpreters, speech and language therapists, victim support etc.

- Consider what other forms of abuse may also be present. Financial abuse is often accompanied by emotional abuse and neglect, self neglectt and sometimes physical abuse.

- Police – 999 or 101

- MASH – 0800 137 915

- Trading Standards – 01296 383212

New Li nguistics of Romance Fraud Booklet

nguistics of Romance Fraud Booklet

A new romance fraud e-booklet has been developed by Thames Valley Police’s Economic Crime Unit alongside Dr Elisabeth Carter, Senior Lecturer in Criminology and Forensic Linguist at the University of Roehampton.

What is a romance fraud?

Romance frauds happen when the victim thinks they’ve met the perfect partner through an online dating website or app, but the other person is using a fake profile to form a relationship with them. They’re using the site to gain the victim’s trust and ask them for money or enough personal information to steal their identity.

How does it happen?

Romance fraudsters are masters of manipulation and will go to great lengths to create a false reality in which an individual feels that they are making reasonable and rational decisions.

The challenge for many family and friends of romance fraud victims is being able to disrupt the false reality created to enable the victim to see the situation for what it really is – a fraud.

Tactics

This booklet has been designed to demonstrate the clever tactics used by romance fraudsters with a view to empowering the knowledge of our communities.

It also dispels the myths of shame and embarrassment often associated with this crime by highlighting the link to coercive control.

You can access the booklet by visiting the Thames Valley Police website.

Detective Inspector Duncan Wynn of Thames Valley Police’s Economic Crime Unit said: “Romance fraud can have a catastrophic impact, from the emotional devastation to the financial losses. We have worked with Dr Carter, a forensic linguistics and criminology expert, to raise awareness of the manipulative tactics that romance fraudsters use. It’s so important that if you feel you have fallen victim to a romance fraudster that you seek help by reaching out to Action Fraud or Victims First if you’re in Oxfordshire, Berkshire or Buckinghamshire. If you live outside of the Thames Valley, you can contact Victim Support.”

Dr Elisabeth Carter, Senior Lecturer in Criminology and Forensic Linguist at the University of Roehampton said: “Romance fraudsters are masters of disguise and deception, and this publication shines a light on the tactics they can use, so you can keep yourself and your loved ones safe. It provides important information about the range of different ways fraudsters will attempt to groom, manipulate, and persuade individuals into a position where they feel compelled to send money. If you are at all doubtful about a relationship you are in or a relationship someone you know is in, please help stop fraud in its tracks and seek advice from Action Fraud.”

To view Dr Carter’s complete academic paper that inspired the booklet, please visit https://doi.org/10.1093/bjc/azaa072 where it will be available for free for one month from 15 November 2020.

Buckinghamshire Safeguarding Adults Board has been working on at the area of financial abuse and SCAMS and in particulare the issue of when someone may lack the mental capacity to understand the form of financial abuse that they are a victim of. As a Board we offer E Learning on Mental Capacity and SCAMS which is available on our Training page as well as Face to Face Traning on the same subject.

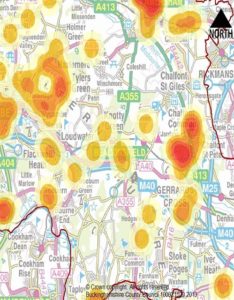

We have also been looking at where the incidents of certain types of abuse occur using data from Trading Standards:

The Map highlights that there is a cluster of financial abuse in the south of the county which may relate to the location of the are which is close to the motorway and is an area where there is a large number of elderly residents. It is this information which the Board is now using to assist partner agencies in targeting their resources.